December 2017 – Tax Worksheet updated with 2017-2018 Section 24 changes

Hello to all our customers! We have recently updated the web site to reflect legislative changes to the way in which financial cost relief is applied for tax returns of individual landlords.

Tax Worksheet updated with 2017-2018 Section 24 changes

We have updated the tax worksheet to take into account the new rules for financial cost relief from 2017 onwards.

In a nutshell, from April 2017, HMRC are restricting the finance cost relief for individual landlords on residential properties to the basic rate of income tax. The restriction will be introduced in stages from 2017 through to 2021 and will apply mostly to individual landlords (not companies) who manage residential properties and who pay higher rate tax.

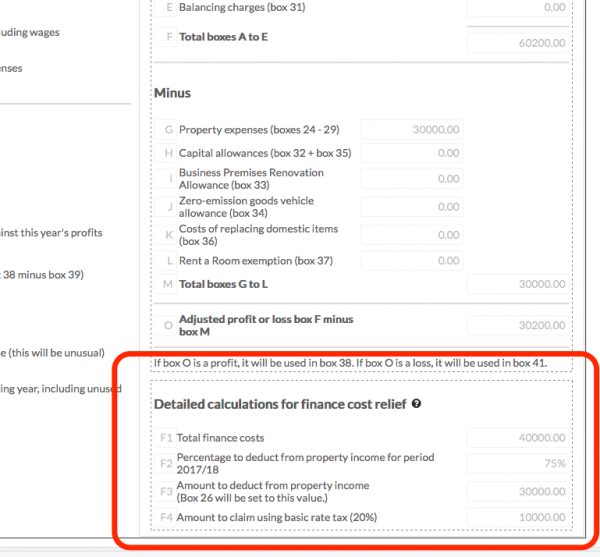

The following screenshot shows the additional calculations displayed on the tax worksheet for financial periods after 6/Apr/2017:

The detailed calculations section of the tax worksheet displays details of how Finance Cost Relief is calculated for your business as follows:

| Field | Description |

| F1. Total finance costs | The total expenditure your business has incurred for financial costs such as loan interest. Specifically, this aggregates all transactions in the financial period with tax category ‘Loan interest and other financial costs’. |

| F2. Percentage to deduct from property income | The percentage of the total finance costs that can be deducted from property income for the period in question. |

| F3. Amount to deduct from property income | The actual amount that can be deducted from property income – i.e. F1 divided by F2 x 100. This figure will be inserted into box 26 of the tax worksheet |

| F4. Amount to claim using basic rate tax |

The remainder of the finance costs which can be claimed as a reduction from your income tax liability at the basic rate of tax (currently 20%). Refer to the HMRC guidelines for further details. The way to claim this amount will be clarified once HMRC publish the 2017/2018 self-assessment forms. |

Some important notes:

The finance cost relief section of the tax worksheet is provisional until HMRC publish full details of the final SA105 form for 2017/2018.

For further details see the following HMRC publications: