October 2015 – Improved Support for Landlord Statements

Improved Support for Landlord Statements

It is now possible to create and manage statements for landlords in a more intuitive manner. If your business is an agency or you are managing property on behalf of other landlords then you can now use the especially designed Landlord Statement page to create, manage and produce landlord statements showing monies due between your business and the landlords you are managing. At the core of this is an extension of the financial model to allow for separate tracking of account transactions versus regular transactions. For example, as an agency you can now:

- Track a rent payment from a tenant to a landlord separately to the actual payment from the tenant to one of your client fund accounts.

- Record payment of funds from your client fund accounts to the landlord in order to pass on the rent income you have collected on their behalf (less any fees and expenditure).

- Record transfer of funds from your client fund accounts to your business accounts in order to collect the management fees you have charged.

- Produce a statement to show your financial position with respect to a client landlord.

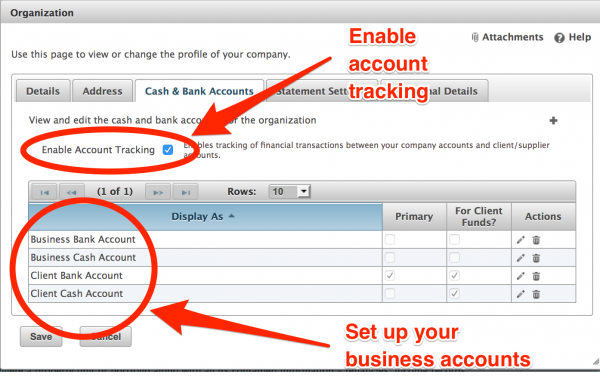

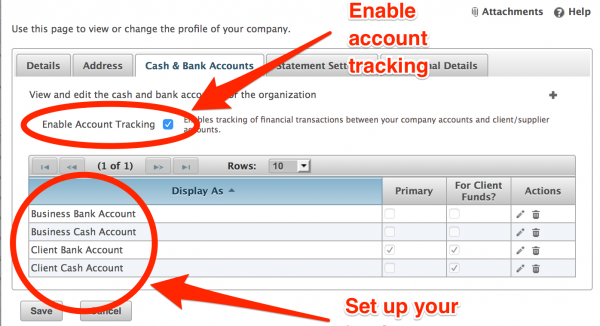

Enabling Account Tracking

To enable the extra features, log in, click on the Admin link at the top of the page and access your Company Profile. The Cash and Bank Accounts tab allows you to control the new features as shown in the following screenshot:

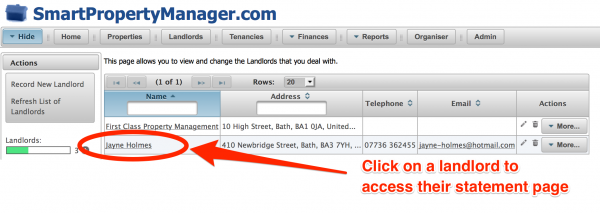

Viewing Landlord Statements

To access the new Landlord Statement functionality, from the Landlords page, click on the name of a landlord to view their statement page as shown in the following screenshot:

This will navigate to the statement page as shown here:

A few highlights:

- The summary section at the top automatically calculates your financial position with respect to the landlord, taking into account rent income received, expenditure and fees and any payments previously made to the landlord’s accounts.

- The landlord statement clearly separates regular transactions (rent income, expenditure, etc.) from account transactions.

- Use the links on the left-hand side of the page to export or email landlord statements.

- The system automatically calculates the opening balance for each statement. However, if required, opening balances can be overridden on a per-Landlord or per-statement basis.

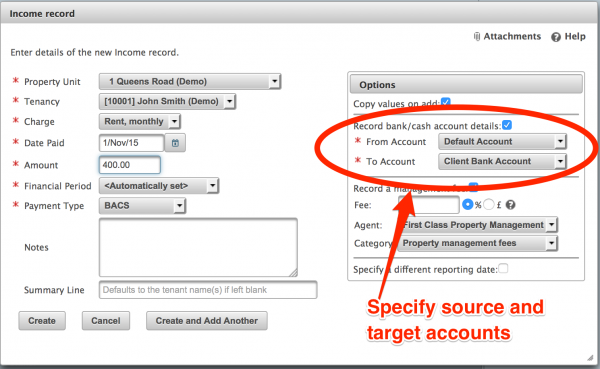

Recording Account Transactions as part of Regular Transactions

When account tracking has been enabled you will see two new fields on the Income and Expenditure dialogs to allow specification of the source and target bank/cash accounts for the transaction as shown in the following screenshot:

Recording Additional Account Transactions

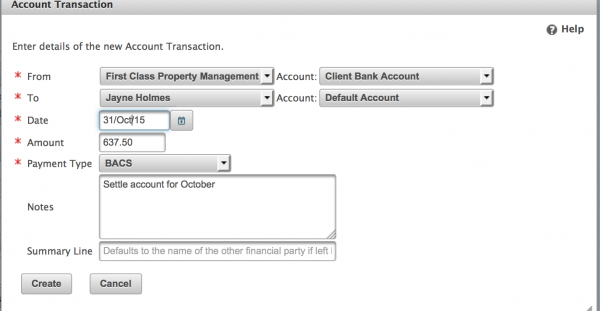

It is possible to explicitly record Account Transactions directly from the statement page for a landlord using the link called Record Account Transaction on the left-hand side of the landlord statement page. Examples of where this is useful:

- Recording a payment of rent income due to a landlord (less fees and expenditure).

- Recording a payment of management fees earned to your business.

- Recording a transfer of funds across accounts.

The following screenshot shows the new Account Transaction Dialog:

Learn More

For more information refer to the Landlords topic in the online help system. Alternatively you can contact us for further information.