August 2018 – GDPR – Tax Worksheet updated with final 2017-2018 Section 24 changes

Dear customers – this update describes some recent improvements we have made to the web site and also an update on new GDPR legislation which come into effect this month.

Hope you find the information useful. As usual you can contact us if you have any questions.

GDPR

The EU General Data Protection Regulation (GDPR) is set to take effect on May 25, 2018. We have recently completed a review of the website to ensure we meet it’s requirements. For more information on the legislation and what it means, read the following post:

SmartPropertyManager.com & GDPR

Tax Worksheet updated with final 2017-2018 Section 24 changes

From April 2017, HMRC are restricting the finance cost relief for individual landlords on residential properties to the basic rate of income tax. The restriction will be introduced in stages from 2017 through to 2021 and will apply mostly to individual landlords (not companies) who manage residential properties and who pay higher rate tax.

In December we pre-emptively made changes to the tax worksheet in order to take into account the new rules for financial cost relief from 2017 onwards.

With the release of the final SA105 form in April 2018, we have now updated the tax worksheet to reflect the final published layout and guidelines.

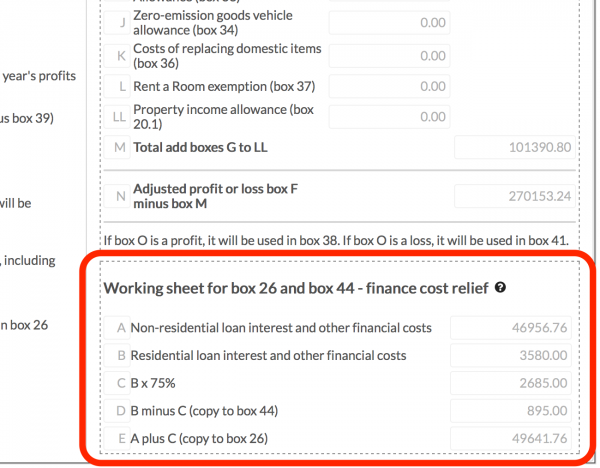

The following screenshot shows the lower part of the detailed calculations section of the tax worksheet which now matches exactly the format used by HMRC SA105 form:

These fields are calculated as follows:

| Field | Description |

| A. Non-residential loan interest and other financial costs | The total expenditure your business has incurred for financial costs such as loan interest on non-residential property. Specifically, this aggregates all transactions in the financial period with tax category Loan interest & finance costs (Non-residential property). |

| B. Residential loan interest and other financial costs | The total expenditure your business has incurred for financial costs such as loan interest on residential property. Specifically, this aggregates all transactions in the financial period with tax category Loan interest & finance costs (Residential property). |

| C. Residential finance costs that can be claimed as an expense | The proportion of the residential finance costs that can be claimed as an expense. The percentage used to calculate the proportion will reduce in stages between 2017 through to 2021. |

| D. Residential finance costs that cannot be claimed as an expense | The proportion of residential finance costs that cannot be claimed as an expense. These finance costs can be claimed as a reduction on your income tax liability at the basic rate of tax (currently 20%). Refer to the HMRC guidelines for further details. |

| E. Total finance costs that can be claimed as an expense | The full amount to be claimed as an expense, calculated as the sum of non-residential finance costs (box A) and the proportion of residential finance costs that can be claimed as an expense (box C). |

For full details of the changes to finance cost relief see the following HMRC publications: