How can we help?

Making Tax Digital for Income Tax – Step by step

This is a step-by-step guide to using Income Tax MTD through SmartPropertyManager.com

Pre-requisites

- You must use the standard financial year: 6/Apr -> 5/Apr.

- You have only a single UK property business registered with HMRC.

- You have signed up for Making Tax Digital for Income Tax. You can do this by going to the following link:

Steps to Use Income Tax MTD

-

Log into your SmartPropertyManager account.

-

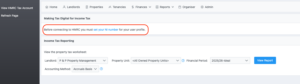

Make sure the financial periods configured in SmartPropertyManager match the expected dates for HMRC.

-

SmartPropertyManager currently only supports Income tax MTD for individuals that use standard tax years starting on 6/Apr and ending on 5/Apr of the following year. The financial periods in SmartPropertyManager must match this. Check this as follows:

-

Go to the Admin page.

-

Go to the Financial Periods page.

-

Make sure the financial periods from 2024 onwards start on 6/Apr and end on 5/Apr. If not, please edit the financial periods and correct the start and end dates.

-

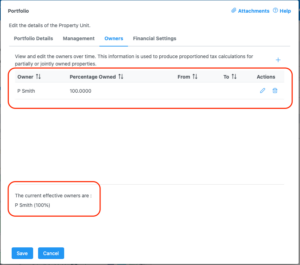

- If you have jointly owned properties then make sure the property ownership rules are correctly set up.

- SmartPropertyManager is able to proportion and report figures for jointly owned properties. To do this, it needs to understand who owns your property units, the percentage owned and over which time periods. You can check the ownership rules as follows:

- Go to the Properties page.

- For portfolios, edit each portfolio and go to the Owners tab. Make sure the ownership rules are correct.

- For property units, edit each property unit, go to the Additional Details tab and then to the Owners tab. Make sure the ownership rules are correct.

- Useful notes:

- When ownership rules exist on a property unit, they override any rules from the parent property unit or portfolio.

- Conversely, ownership rules defined on a parent portfolio or property unit are automatically applied to any descendant property units that do not have any explicit rules assigned to them. For this reason, the recommendation is to define ownership rules on portfolios or parent property units wherever possible.

- When ownership rules are not explicitly defined for a property unit or for any parent property unit or portfolio, then ownership is defaulted to your main business organization/landlord which would have been automatically created when your account was first registered.

- Below the table, a summary is displayed of the effective owners as of today. If no ownership rules are explicitly defined for the property unit being edited, then it will inherit and display the ownership as defined from the parent property unit or portfolio.

Portfolio & Property Unit Owners

- Go to the UK Property Tax page by clicking on Finances and then UK Property Tax in the main menu.

- Record your national insurance number.

- Connect SmartPropertyManager.com to your HMRC account.

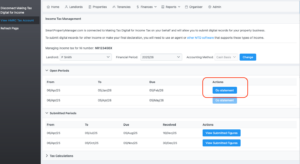

- Once connected, you will be returned to the UK Property Tax page which will now display additional information:

- The Landlord and Financial Period that you are managing.

- The Accounting Method that is registered with HMRC.

- Open Periods: The list of quarterly periods which have not yet been submitted.

- Submitted Periods: The list of quarterly periods that have been submitted.

- Tax Calculations: The list of requested tax calculations. You can request a new tax calculation by clicking on the plus icon in this section.

MTD Connected

- Make sure the correct Landlord, financial period and accounting method are selected.

- Important: HMRC will only return information for 2025/26 or later. It will not return any information for financial periods before 2025.

- From the Open Periods table, find the next due period and click on the Go Statement button to navigate to the tax worksheet.

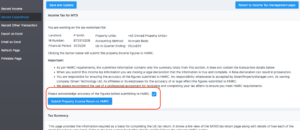

Go Tax Worksheet - Review the figures for accuracy.

- The tax worksheet is laid out in the same way as the regular SA105 form that is used for UK Property Tax self-assessments.

- It is important you fully understand how to complete the SA105 form. Please refer to the official HMRC self-assessment guides for information.

- Review the detail transaction tables for Income and Expenditure to ensure they are complete and accurate.

- Review the figures in the Tax Summary section to ensure they are accurate.

- The boxes which are not editable are calculated from the detail transaction tables.

- The boxes which are editable are your responsibility to enter.

- When ready, submit the figures.

- You will be able to submit the figures for each quarter once you are after the end of the quarterly period end date. At this point, the tax worksheet will display the option to submit the figures as shown in the following screenshot.

Submit quarterly update - Once a period has been submitted, it will no longer appear in the list of Open Periods and instead shows in the list of Submitted Periods.

- A snapshot of the data is automatically saved to your attachments. You can access them through the Organizer page.

- You will be able to submit the figures for each quarter once you are after the end of the quarterly period end date. At this point, the tax worksheet will display the option to submit the figures as shown in the following screenshot.

Known Issues

- Changing the Accounting Method does not always work.

- The system will ask HMRC what the currently registered accounting method is and will show it to you. You can change the Accounting Method by clicking on the Change button. If you attempt this, please log out and log in to make sure it has taken effect. If it has not taken effect, please report the problem to us and we will investigate.

- Viewing Tax Calculations does not always work.

- The Income tax management page shows the list of requested tax calculations and allows you to view them. Sometimes, HMRC does not correctly compute a tax calculation – in which case the calculation details fail to show.